SportCaller’s Co-Founder details what the recent acquisition means to the company’s development and the benefits that SportCaller’s Free-to-Play expertise can bring to Bally’s

In February, Bally’s announced it had acquired free-to-play games provider SportCaller. The deal has seen SportCaller become part of the operator’s interactive division, formed after the operator acquired Bet.Works in November 2020.

Cillian Barry, Co-Founder and CEO of SportCaller, remotely sat down with G3 to discuss what the agreement means for SportCaller’s future and the burgeoning US market.

Could you tell us more about Bally’s acquisition of SportCaller – how long was the deal in the making and what were the major sticking points in the negotiations?

We entered into a process with Oakvale Capital back in September 2020 looking to raise some funding. By November, we were presented with a list of 15-20 different companies and received four formal letters of interest.

From these four, we found Bally’s to be the most suitable partner for us on several fronts. Obviously, the financial package was attractive, but also the opportunity to have a ring-side seat for the US market. It was an offer that would have been very difficult to walk away from.

We entered into an exclusive arrangement with Bally’s in late December and, despite lawyers on both sides only being introduced to each other at the beginning of January, the deal was wrapped up by 5th February. It was an incredibly fast and efficient process. Bally’s were good to their word and goodwill was shown on both sides.

From the outset of founding SportCaller, was being acquired by a major operator always on the cards at some point? Was being acquired part of your long-term planning for SportCaller, or was the offer simply too good to refuse?

Since we started the business in 2010, SportCaller has been through two stages of development. The first four or five years we were really making it up as we went along. We had a great community of horse racing fans and had our early stage free-to-play games in development, but we were really just trying to find our way in the dark. Towards the end of the first stage, tier one operators began to show an interest in some of the games we were running.

Stage two began around 2016 when we worked with Paddy Power on the Euro’s which significantly raised our profile and we brought in a couple of key hires which made a huge difference. Following these appointments, we started adding more clients including Kindred and moved beyond the UK into Europe, Australia and the US, which was a big step change.

In 2015, we were self-funded and financially broke making around €20,000 a month. By the end of stage two, we got to a point where we were making €400,000 over the same period with very good profit margin.

We looked at it internally and considered our next steps for stage three which was to grow ten times our size over the next three years. We wanted to go from five or six million in annual revenue to 50 or 60 million. We had every confidence we could do it, but it would mean creating a completely different business much like the transition from stage one to two.

We recognised we needed to raise some funding support to begin a new stage of accelerated growth – make key hires, sign many more clients, produce more products, upgrade the platform and put staff on the ground in new regions.

From a personal perspective having founded the company and seen it go through all those stages, which was very stressful at times (and I’m probably massively understating it there!), it was mostly about keeping our heads above water and believing in the product. When I began the business, it was a financially reckless thing to have done and over those first few years I was unsure whether I had the nerve and appetite to keep rolling the dice.

When we were looking at going from stage two to three and there was a lot of interest from the market, I was very open to it. We decided the best way to enter this new phase was with a partner and that’s where Bally’s came in.

Were you relieved or saddened to pass over the reins?

I am not particularly sentimental but, if anything, it was a relief to gain some financial security and, if anything, it was comparable to reaching the end of something. It offered a quiet satisfaction knowing we had built something with a really strong team, good technology and happy clients. For those three things to be recognised by a public company wanting to acquire us showed we had really achieved something.

What does SportCaller bring to Bally’s with regards to product development and expertise? What role will SportCaller play in augmenting Bally’s interactive expansion plans?

Over the years, we were probably more of a product company than a sales company. We take great pride in making quality products with our brilliant product managers and engineers.

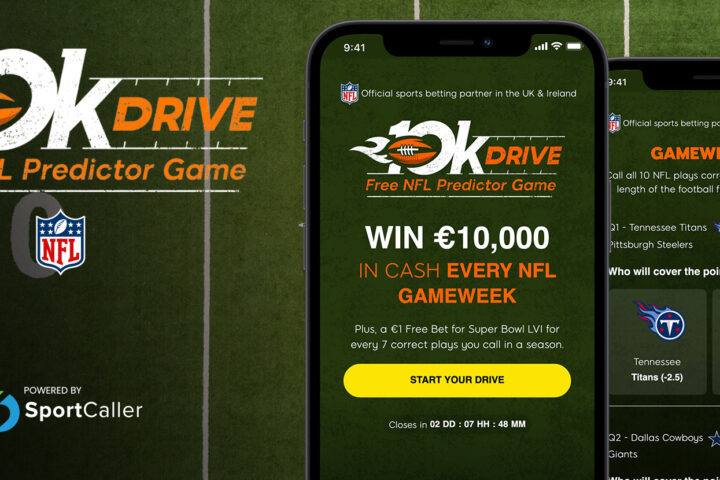

We do free-to-play very well which is going to help Bally’s engage and activate its audience. Alongside Bally’s’ huge Sinclair Broadcast Group partnership, this will help them grow an audience in pre-regulated states. We understand how to convert and retain players from a free-to-play game into a real bet through to a long term, active customer.

If we deliver on each of these, then we will have played an important role in Bally’s success.

What does the acquisition mean for SportCaller’s future? What does the deal mean for your current client relationships?

It is business as usual. When we closed the deal on Friday 5 February, we were back to work on Monday doing the same job. We are still looking after our clients such as Flutter, Kindred and Entain and have a large team dedicated solely to our B2B clients. At the same time, we have another part of the team working on the Bally’s F2P roadmap.

Focusing on the US market, as more states come online, do you expect challenger operators to infiltrate the current status quo of giant corporations sweeping markets as they open up? How can operators with a lower budget and brand awareness capture the attention of US bettors?

I think and hope there will be some new entrants because the gaming industry worldwide needs an injection of personality to raise its game in terms of innovation. However, the US market has quite a high-ticket price to play. Due to the state-by-state regulation and its licensing model, I think there is space on a local level. You may have some challenger brands as some of the larger states open up such as New York, California, Florida or Texas.

I also think the niche approach might work well by looking at off-centre sports and markets you can bet on. It’s obviously very difficult to go head-to-head with a DraftKings so where do you go if you’re not in the top three but have ambition?

Look at what Sky Bet achieved in the UK – they used its broadcast station and made a huge commitment to the execution of the brand. Closer to my home in Ireland, Paddy Power proved the point that “personality goes a long way”.

It’ll be interesting to see how it plays out over the next five or 10 years.

Current US focus is on acquiring players. When do you expect retention to become the goal?

I don’t think they are mutually exclusive. I think US operators need to be nailing their acquisition whilst also addressing their retention. It is going to be a land grab for the next three to four years and at some point, someone is going to break the mould and seriously devote resources to CRM. I think that as markets mature a little bit more, operators will give budget to the team responsible for retention as it’s definitely worth investing in.

What is the difference between an acquisition-focused game and a retention-focused game?

Prize and position. The big difference is that they have got a different prize structure. An acquisition game has a huge jackpot whereas a retention game is more of a rewards programme for regular play. Retention games are not front and centre of a sports betting app, it’s a habitual game that players come back for.

The games that were popular in the UK and Europe three years ago were acquisition games. Now looking at William Hill, Coral, Kindred, and Paddy Power, they are retention games. Around big events such as Cheltenham, you want to bring players in on each day of the festival and if you can get them to transition onto the sportsbook, that’s the Holy Grail.

Retention games are a more interesting product challenge as they are subtle compared to the sledgehammer approach of acquisition games. Acquisition is simply about trying to grab an audience and bring them in the door.

Finally, what are your personal goals in the months ahead?

Taking a deep breath! I am really looking forward to continuing my role running SportCaller and working with Bally’s. Removing the financial existential threats means I can better focus on our products and the medium to long-term.

Read the full G3 Interactive article.