In this Bettingusa.com article, SportCaller’s Cillian Barry, and the heads of other EU Free-To-Play (F2P) suppliers, examine the value of F2P for the US market – where traditional customer acquisition and retention tools are becoming unsustainably expensive.

Thanks to Scott Langley at Bettingusa.com for the publication of this article.

There may soon be little the legal US sports betting market feels it can learn from the European experience, but one of the few areas where it can still look for informed guesses about the future direction of the market is in the area of free-to-play games.

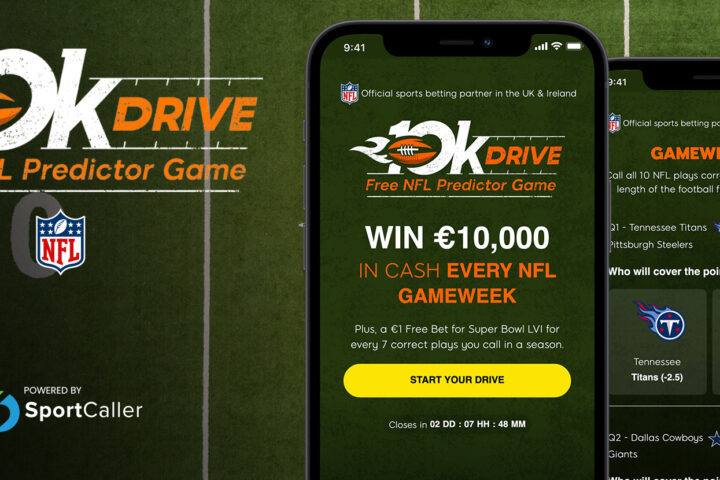

Sky Bet’s Super 6 game is the most successful and high-profile free-to-play game in the UK and has shown, according to Cillian Barry, chief executive at Dublin-based Sportcaller, how Sky Bet now “owns the recreational player in the UK.”

But the million-dollar question is whether that “magic sauce” can now be converted to the various US markets, where FOX Bet has launched a version of Super 6. Or, as Barry asks: “Does it travel?”

Why Free-to-Play

First, we have to get used to a new acronym – F2P. In Europe, there is a bank of evidence that providing F2P games provides operators with new retention tools.

With restrictions on advertising and marketing now a fact of life across an increasing number of regulated European jurisdictions, it means the marketing tools of the trade, such as bonuses and free bets, are now severely curtailed.

“Into that vacuum F2P is beginning to play an increasingly important role, using games in smart and responsible ways,” says Barry. “It has become a strategic necessity. Otherwise, marketing and growth were looking problematic.”

“At a superficial level, the ability to offer something engaging and entertaining, for free, is natural incentive to play a game,” says Nathan Rothschild, co-founder and partner at GTGnetworks.com which provides F2P games to the likes of DraftKings, Oddschecker, and other Tier-1 operators around the world. “It is human nature to want to win – creating a friendly but competitive environment with bragging rights on offer is extremely compelling. The other critical element is customization – clients want a solution delivered to their needs and the needs of their users, so off the shelf solutions are no longer viable.”

A Different Drum

The appeal of F2P games translates to any market. Yet with the operators in the US still working in the acquisition phase – and state-by-state opportunities sitting uneasily with nationwide marketing campaigns – it throws up different challenges for F2P game providers, as the market is in an acquisition phase.

“Most European sports betting markets are mature, and most active punters have accounts at two or more books at least,” says Daniel Kustelski, co-founder and chief executive at Chalkline Sports. “In those hyper-competitive markets where sports betting has been legal for years, retention is critical, since going and finding new customers is so hard.”

In the US, though, “everything is still completely new.” Kustelski cites data from the American Gaming Association (AGA) that anywhere between 30m-50m players will place their first sports bet in the next three-to-five years.

“Given the landscape, all operators are simply trying to acquire customers, so most of their energy and resources are spent on acquisition first,” Kustelski adds. “F2P games are legal in all 50 states. With CPA bonuses running at approximately $400 for affiliates in New Jersey, it makes business sense for all operators to acquire customers as soon as possible to reduce the inevitable costs.”

The Rules of Attraction

John Gordon runs a company called Incentive Games, which produces a variety of multi-sport games, and he says there are still barriers that have to be overcome in persuading US customers to sign up for a game or app.

US F2P customer barriers:

- Customer education. They are just not used to the betting games we have been exposed to for generations.

- Motivation to commit to a call to action. Customers are inherently difficult to persuade to do something. If you want them to install an app, you need to ensure you have sufficient motivation for them to do so. They know how intrusive apps can be.

- Engage, engage, engage. More than anywhere else in the world, the US customer needs the best quality of product and it has to engage them from the first second to the last. Sub-standard products will not survive.

- Do not look like spam. We did a $1 million free-to-play game, and tested against $100k free to play jackpot game. The latter converted more as it seemed more achievable.

- All the trimmings. UX/UI, language, game page transitions all have to be on point.

That last point was echoed by others.

“Ultimately operators need to be providing users with a game that looks great, is clean, easy to play, and ultimately is engaging,” says Rothschild. “It’s a specialist skillset.”

Barry says that ultimately the US F2P space will end up at the same terminus as the European space – a “wildly competitive” marketplace where F2P will be one more tool in the marketing armory.

As to whether the Super 6 experience will be replicated in the US, he does suggest that Fox Bet could be in a winning position. “Fox Bet has a lot of ingredients for it to work,” he says. “The audience will go for it but the challenge will be how to convert to active and funded accounts.”

“That is what the guys in Leeds at Sky Bet always understood – moving people from pond A to pond B. There are ways you can do that, and what works with one audience might not work with another.”