SportCaller’s Cillian Barry assesses the highly competitive sportsbook land-grab stateside from the POV of bonusing and how F2P is showcasing its versatility and muscle.

It’s a common refrain that operators panning for gold in the US sportsbook rush have “learned valuable lessons” from their European forerunners, particularly in mature markets like the UK. However, the jury remains out on whether the current reality matches the rhetoric.

Too much advertising, too little regulation was essentially the conclusion of the House of Lords review earlier this year. However, it wasn’t just in the UK. Italy initiated an advertising ban, and Spain has been swift to follow suit in silencing its own ubiquitous calls to bet. Free bets, bonuses and odds-boosts have all come and made a fine mess which everyone needs to clean up. After all, in the modern media era, exceptions get amplified and scandals can bring the house down.

In short, we need to be proactive, not reactive as an industry. Needless to say, it’s far better to retain and grow your base responsibly than acquire and expire. Nevertheless, in the furious stateside land-grab, where revenue and customers mean more (to share price, or simply because brands are in “growth” stage) than profitability or efficiency, it seems certain operators will continue to use the most aggressive tools of free bets, eye-popping odds and money-back offers. Long-term, though, that just represents an unsustainable race to the bottom – and it’s definitely not sustainable across all states.

There are also questions around whether bonusing is attracting new bettors or simply creating a short-lived boomtown for a promiscuous existing audience. Cheltenham Festival-levels of bonusing aggression are on display every day in the US. And looking at the size of some of the acquisition free-bet bonuses doing the rounds ($1k and $500 are not unusual amounts) you just won’t find this on any European books.

Such spiraling CPAs have quickly become par for the course. What’s perhaps less anticipated is the fact that promotional credit is now accounting for the lion’s share of record-breaking early state-by-state revenues. In Pennsylvania, the only state to reveal how much operators handed out in free bets and bonusing, $12m of its $13m in September sportsbook hold was accounted for in bonuses.

Such head-turning figures may prove outliers, especially with sports-starved NFL fans re-engaging with the 2020-21 season, but beg some serious questions as to what’s really going on under the hood in other states.

Once this “gold rush” settles down and players have to determine their book of choice for more organic reasons, a look back across the pond to mature markets in the UK and Europe points to F2P having a substantial role to play in offering a more sustainable, and responsible, approach.

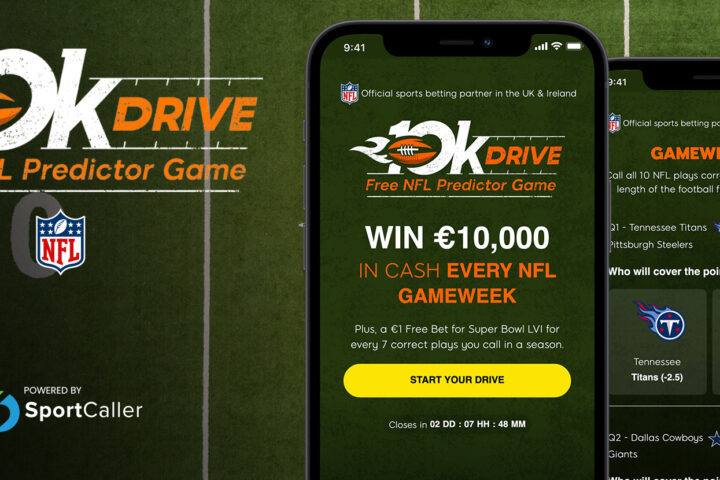

At SportCaller we have been lucky enough to sit at the heart of this movement, powering most of the retention-focused games run by leading operators. Paddy Power have Beat the Drop in the UK, and Betfair run the same product across multiple European (and LatAm) territories, Coral have Racing Super Series, Kindred have Streakr across 13 countries, while William Hill have just launched the immediately successful FreeOr4.

F2P has stood its ground

We have been working with all these clients for some years now and it is common to all that the F2P model provides a channel that can illuminate the most cost-effective way to build socially-responsible and educational practices which reliably bring in customers – not just this week, but every week. Certainly, in the UK and beyond, F2P has stood its ground as an acquisition and retention mechanism that has evolved far beyond the obsolete bonusing techniques of its traditional rivals.

They key difference here though when compared to the current environment in the US is that betting is very much established and part of the fabric of enhancing the enjoyment of watching sports. That is to say that it is much more mainstream, with operators competing for mass-market audiences alongside more dedicated punters. There is no doubt that this mass-market US audience will take some time to organically “arrive”.

F2P has already allowed SportCaller’s media clients, such as CBS, to build up significant bases of highly engaged players who’ve been served gameplay premised on sports betting props and parlays every week. The size and profile of these audiences do not mirror that of the more dedicated hard-core bettor, but rather that of the mass-market player in established betting landscapes, as they become more accustomed with the mechanics of betting and get a sense for the enhanced enjoyment of sport it delivers.

SportCaller’s market-leading platform sees us lead the field in terms of concept-ideation to game-launch efficiency, taking the sting out of protracted development and rollout. In fact, the new game in our ongoing partnership with US powerhouse, FanDuel, replicates the real-money-betting experience for players, offering the ability to choose how much they invest on each question, with points tracking the underlying odds for correct predictions.

Moreover, FanDuel’s flexible and varied deployment of F2P has provided a deep and informative case study on the utility of games as a means of driving acquisition with reduced CPAs. F2P games are compliant wherever you set your scene in North America. So, FanDuel have leveraged their competitive advantage, promoting double-digit games nationally to millions of current and would-be players to build both brand awareness and database in the process.

In order to engage this new demographic, they have moved away from eye-catching jackpots that are nigh-on impossible to win, instead preferring to ask simple questions around prop-bet opportunities with free site credit for every correct answer. And on the occasions when FanDuel do run games with larger jackpots, they take a novel tack – gearing the mechanics to probabilistically produce more winners rather than just the odd one or two.

Indeed, on the Super Bowl LIV, they combined both approaches, with an attainable offer of $100 for every player getting 12 out of 15 questions correct, and a jackpot of $15k for anyone shrewd, or lucky, enough to get all 15 right.

A light touch product

In this sense, FanDuel are being very shrewd. They appreciate that they will have multiple winners of their games and are happy to pay out every week – knowing that those receiving rewards are doing so because they have engaged with a light-touch product, based around betting markets whose intricacies and formats can often seem confusing to the novice – particularly given some of North America’s unique terminology and odds displays.

Earlier this month, Maryland, South Dakota and Louisiana became the latest three states to approve sports betting. And by the close of next year, at least 25 states and the District of Columbia could have legal sports betting in place.

As David Schwartz, a gaming historian with the University of Nevada Las Vegas observed: “It appears that Americans are becoming increasingly comfortable with legalized gambling. We have also reached a point where voters seem satisfied that legalizing gambling will offer positive returns for their state.”

This progressive regulatory movement will, in turn, usher in the mass-market audience that will sustain growth, driving down CPAs and pushing up margins. Education and getting a feel for sports betting must come first, though, and this is why F2P is so important to US operators. Especially as F2P skews towards attracting a younger customer (much more digitally engaged and socially active with their peers via these games) who represents, long-term at least, the target demographic that operators are trying to secure.

For the moment, then, undercutting acquisition costs and tired methodology will continue to confirm the importance of free-to-play in the US. Down the track, F2P can also reduce churn and improve market share. Accordingly, those US operators who are laying the groundwork for alternative acquisition and retention will benefit in the medium-term as promotions continue to prove expensive and need to be reined in.

As we’ve also seen in the UK, we may find that regulators – and the public – begin to view the blunt tools of free bets as excessive and demand tighter curbs and controls. F2P’s light touch neatly sidesteps any accusations of aggressive marketing, however, and will remain available long after the lobbyists look to dampen operators’ exuberant spirits for enticing people with “risk-free” promotions.

Of course, the past is always influencing the present. Yet its mistakes need not be repeated. Which is why it’s encouraging to see the States already evolving to adopt F2P games as a pivotal go-to-market product for sports fans. A softer, more instructive and socially responsible approach has to be the preferred introduction to stateside sports betting. And we shouldn’t need history to teach us that.

To get in touch, email: info@sportcaller.com

Thanks to SBC Americas for their kind permission to reproduce this article.