SportCaller MD Cillian Barry talks to Gambling Insider about the growing importance of Free-to-Play (F2P) in the US and unpacks its unique benefits in recruiting and retaining new stateside audiences

However, I’m glad to say that in a year of unimaginable change, we’re finally starting to see some welcome progress around exciting new products, technology and sensible solutions to our ever-evolving landscape. Free-to-play (F2P) has been in the vanguard of such advances over the last 12 months, a period in which F2P has greatly grown and adapted as a genre, staking a claim to being recognised as an industry vertical in its own right. This dynamic shift in status was endorsed by the Investor Presentation for the recently completed Flutter Entertainment / The Stars Group (TSG) merger, where F2P was listed as one of six key product tent-poles – alongside more mature industry perennials such as Sports Betting, Casino and Fantasy.

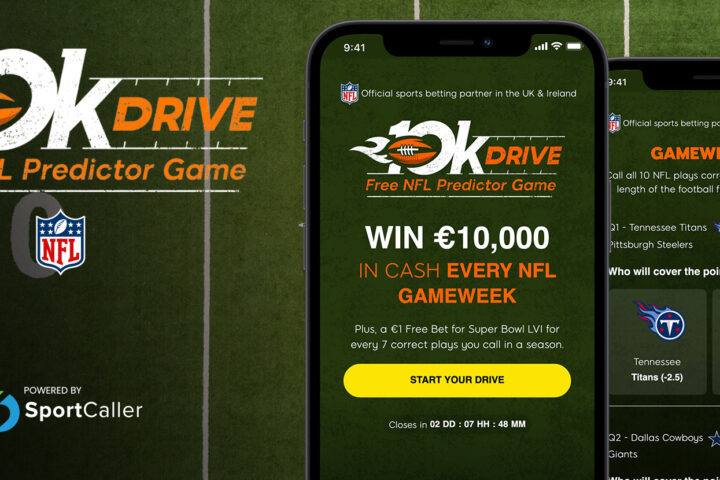

SportCaller are the market leader in F2P for the online gambling industry and the strategic significance of F2P has been demonstrated by our growth over the past year. We’ve rolled out a combined total of 44 new games, which marks a step change on the 22 games rolled out over the previous three years. In this spell, we also doubled our active clients, highlighting the fact that not only are more operators pressing F2P into service, but they are also finding more and varied ways in which it can be deployed. Consequently, we now offer over 90 games across 37 countries and in 20 languages. However, perhaps most significantly, the last year has seen us firmly establish a presence in the US, releasing 18 new games for five clients – including top-dog DFS provider and online betting operator FanDuel, and the number-one-ranked TV network in CBS.

“Morgan Stanley Research estimates that US Sports Betting and iGaming revenue will grow from just under $1.5B in 2019 to $12B by 2025”

Morgan Stanley Research estimates that US Sports Betting and iGaming revenue will grow from just under $1.5B in 2019 to $12B by 2025. So, while many of our European clients are primarily looking at retaining or competing for market share in a mature marketplace, the US will very much remain an acquisition play for some time to come. Marketing budgets to gain an early foothold are running into hundreds of millions, with CPA rates topping $1,000 per player in some states. At the heart of it all, the big betting companies, sports franchises and TV networks all now view F2P as a core strategy towards acquiring players at reduced CPAs.

Market leaders FanDuel have been dexterous in their use of F2P, releasing 10 games with us since first launching around 2019 March Madness, college basketball’s $933m jamboree. In that short space of time, they have sought to innovate, evolve and refine their approach. New entrants to the market, alongside existing incumbents about to throw their wallets at it, would do well to look at some of the very inventive stuff that they have accomplished.

“…F2P games are compliant wherever you stick your pin on a map of North America – promoting games nationally to millions of current and would-be players, building both brand awareness and database”

FanDuel have harnessed the happy reality that F2P games are compliant wherever you stick your pin on a map of North America – promoting games nationally to millions of current and would-be players, building both brand awareness and database. In order to engage this fresh demographic, they have veered away from eye-catching jackpots that are practically impossible to win, and instead have asked simple questions around prop-bet opportunities with free site credit for every correct answer.

This has also served to educate players around the various intricacies of gambling terminology, with natural-language alternatives that clearly articulate any betting proposition, whether you’re an expert or a novice. Cutting through the jargon is crucial (e.g. “more or less than 46.5 total points” instead of “over / under 46.5 total points”) if we are to remove unnecessary barriers to engagement.

FanDuel have harnessed the happy reality that F2P games are compliant wherever you stick your pin on a map of North America – promoting games nationally to millions of current and would-be players, building both brand awareness and database. In order to engage this fresh demographic, they have veered away from eye-catching jackpots that are practically impossible to win, and instead have asked simple questions around prop-bet opportunities with free site credit for every correct answer.

This has also served to educate players around the various intricacies of gambling terminology, with natural-language alternatives that clearly articulate any betting proposition, whether you’re an expert or a novice. Cutting through the jargon is crucial (e.g. “more or less than 46.5 total points” instead of “over / under 46.5 total points”) if we are to remove unnecessary barriers to engagement.

When FanDuel do run games with larger jackpots, they adopt a refreshing approach towards doing so, gearing the mechanics to probabilistically generate more winners rather than just the odd one or two. On the Super Bowl earlier this year, they combined both approaches, with an attainable offer of $100 for every player getting 12 out of 15 questions correct, and a jackpot of $15k for anyone shrewd, or lucky, enough to get all 15 right.

This flexibility in the use of F2P games came to the fore during the sports shutdown when FanDuel and BetMGM had to abandon their ready-to-go March Madness offerings and quickly pivot to an alternative means of engaging players in the absence of any live sports. We quickly spun up prediction contests on the inaugural NBA 2K Players Tournament, and then released daily quiz games prompting players to both play and refer their friends in an organic way, leveraging the social fun and competitive aspects intrinsic to these games.

The return of the PGA Tour in June saw us launch with our first media partner in the US, the sports division of top-ranking TV Network CBS. While it’s always a welcome feather in the cap to acquire such a huge brand as a client, the real validation is that they view F2P games as a pivotal go-to-market product for sports fans and sports betting.

“The key takeaway from all of this is that the industry, and those interested in working with the industry…now consider F2P a softer, and more educational and socially responsible, introduction to sports betting”

When FanDuel do run games with larger jackpots, they adopt a refreshing approach towards doing so, gearing the mechanics to probabilistically generate more winners rather than just the odd one or two. On the Super Bowl earlier this year, they combined both approaches, with an attainable offer of $100 for every player getting 12 out of 15 questions correct, and a jackpot of $15k for anyone shrewd, or lucky, enough to get all 15 right.

This flexibility in the use of F2P games came to the fore during the sports shutdown when FanDuel and BetMGM had to abandon their ready-to-go March Madness offerings and quickly pivot to an alternative means of engaging players in the absence of any live sports. We quickly spun up prediction contests on the inaugural NBA 2K Players Tournament, and then released daily quiz games prompting players to both play and refer their friends in an organic way, leveraging the social fun and competitive aspects intrinsic to these games.

The return of the PGA Tour in June saw us launch with our first media partner in the US, the sports division of top-ranking TV Network CBS. While it’s always a welcome feather in the cap to acquire such a huge brand as a client, the real validation is that they view F2P games as a pivotal go-to-market product for sports fans and sports betting.

The key takeaway from all of this is that the industry, and those interested in working with the industry to cash in forecasted revenues, now consider F2P a softer, and more educational and socially responsible, introduction to sports betting.

This article was reproduced with kind permission from Gambling Insider Friday.